Hi, I’m Brian.

I’m a serial founder with exits totaling 9 figures.

The origin story

My first foray into business started back in 2012 while in college. My classmates and I started a drone photography company where we pooled together some money and built a few drones that were capable of GoPro camera. We only had a few clients, but it gave me a taste of what it was like to run a business.

The first ’real’ business - Bit Management - a $250 million dollar Bitcoin Mining business

The year 2017 marked my first serious foray into the dynamic world of cryptocurrency mining. As the CTO and co-founder, I created one of North America’s foremost Bitcoin Mining companies, Bit Management. Our rapid rise to a staggering $30 million ARR in a mere three months wasn’t mere luck – it was a combination of market insight, seizing the opportunity presented by the capital movement from China to the US, and a solid business strategy.

Our business model was straightforward but innovative. We built and maintained data centers, and customers entrusted us with their mining devices. By focusing on operational excellence, we offered a value proposition where they retained all generated Bitcoins while we benefited from a markup on operational costs.

Challenges were inevitable. The fluctuating crypto market demanded resilience and adaptability. As several of our clients faced insolvency during the market downturn, we made strategic maneuvers, acquiring their assets and even transitioning to becoming a public entity on Canada’s TSX through a reverse merger. Our tenacity paid off when Bitcoin rallied again, culminating in our Nasdaq listing with an multi nine figure market cap.

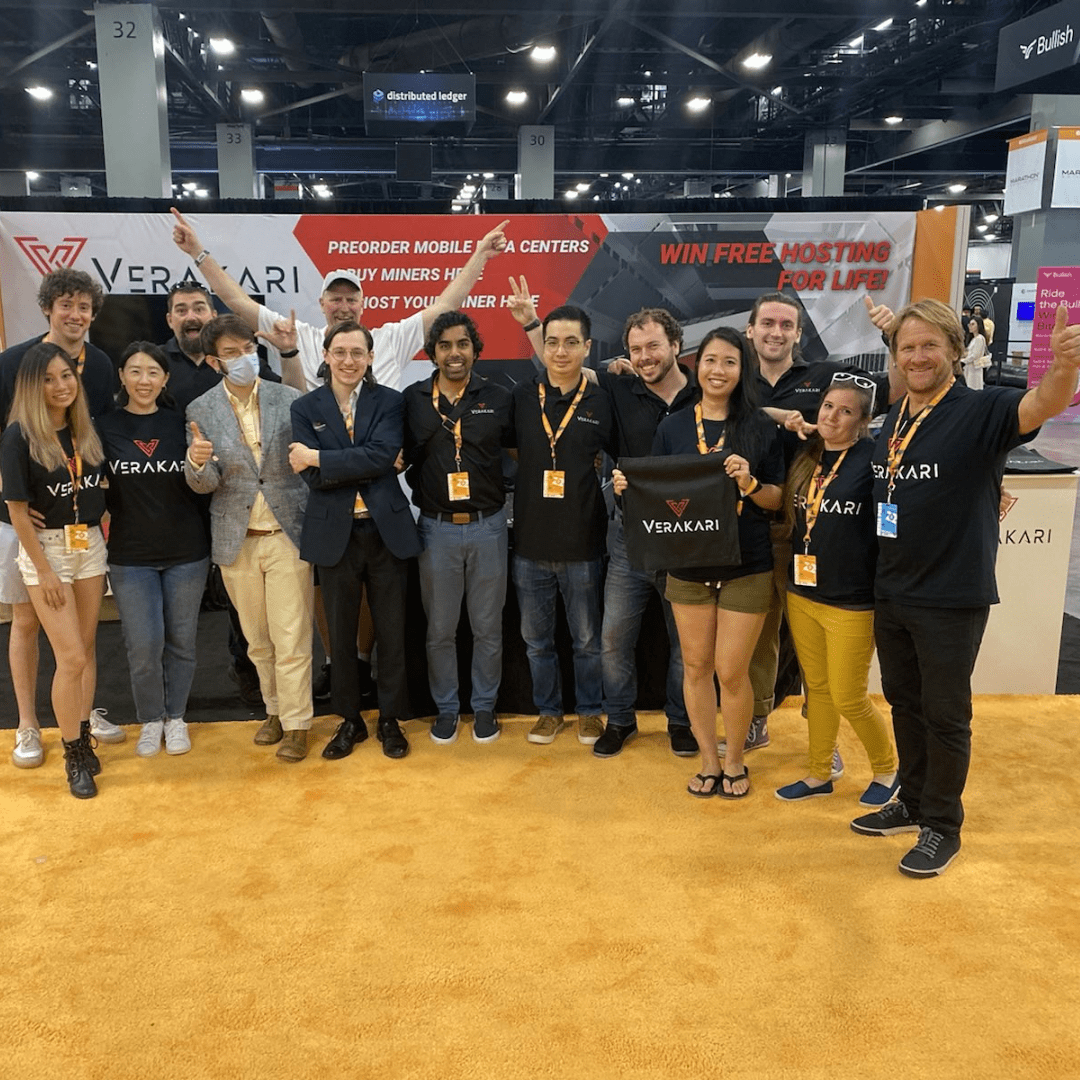

Verakari - From Coder to Crypto Executive

In 2021, I launched Verakari, putting in all the initial seed capital. I hired a total of 7 executives to help me run the business. I also recruited two of the most skilled builders from my previous company to help me construct the data centers.

Our business model was similar to the previous company’s business model. We built and maintained data centers, and customers would provide the mining devices. I put together a debt financing round from one of our customers in order to fund some of the initial capital expenditures.

However, Covid made it challenging to build data centers as the supply chain was heavily impacted. Copper, which is a key component, had its price skyrocket up to 7x. Navigating this market dynamic took the entire team’s effort.

Eventually we were able to secure a multi-eight figure acquisition offer. While it never consumated due to capital market conditions, it was a testament to the team’s ability to execute.

See the mine that we constructed in VR